Today, banking regulators are demanding financial institutions to systematically collect, analyze and store counterparty risk data. Moreover, the regulators and the Basel standards require banks to move from a credit review process based on the opinions of individuals to a formalized process centered on objective inputs and formalized internal rating models. The inputs and outputs of such models must be thoroughly documented.

A bank does not only have a necessity to properly comply with the regulatory requirements, but also wants to reduce its counterparty credit risks by deploying effective rating models that best predict default events.

Financial organizations have piles of qualitative and quantitative data that needs to be interpreted and summarized correctly. However, the lack of appropriate tools makes the process difficult, not allowing banks to make rapid and accurate decisions.

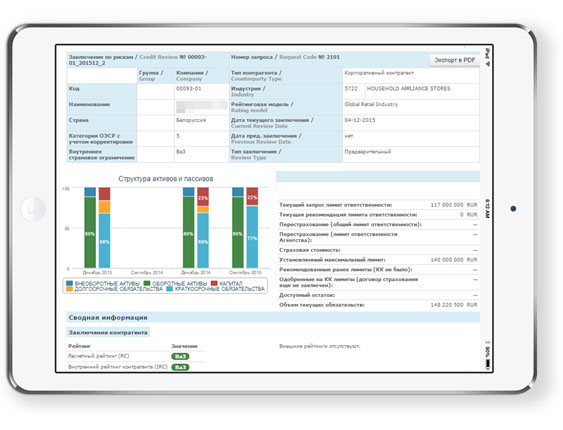

To face these challenges, Seeneco offers its Сounterparty Risk Assessment solution

Collect financial and quantitative data

Analyze and report

Store data in a secure centralized database

Аdvantages

Flexible and customizable. Depending on the internal rating model adopted by a bank, the system can be fully adapted to meet bank’s requirements. If the risk assessment model, rules or processes change, users can easily reconfigure the system to meet the new requirements.

Seamless integration. With its open architecture, the system can easily be integrated with internal CRM and ERP systems, as well as data warehouses. All types of internal and external data sources (e.g. company registers, credit rating agencies, etc.) can be connected for importing data.

User-friendly. The system has a user-friendly interface, and can be accessed using any modern browser, on almost any device. It is compatible with tablets, which is useful for business meetings.